Weather Index based Insurance with CBDC

- Arka Roychowdhury

- May 16, 2023

- 3 min read

A Weather Index based insurance is a special class of insurance, that responds to a predefined weather based objective (measurable) variable (eg: cumulative rainfall in cm). These objective variables or parameters, correlate as closely as possible with the yield of the crop for which the policy is written. Indemnity payouts are triggered if the value of the parameter/ objective variable breaches a defined threshold (eg: cumulative deficit rainfall breaches a defined threshold of x cm). Typically, a locally installed weather station or IoT devices monitor these defined parameters continuously, but it is possible to get data from other sources such as satellite imagery or reliable 3rd party sources. Such insurance schemes could prove critical for providing social and economic protection against unforeseen events, especially in markets where the insurance industry is less mature. CBDC based parametric indemnity payout can vastly improve citizen well being and insurance policy penetration.

Anatomy of a Weather Index based Insurance contract

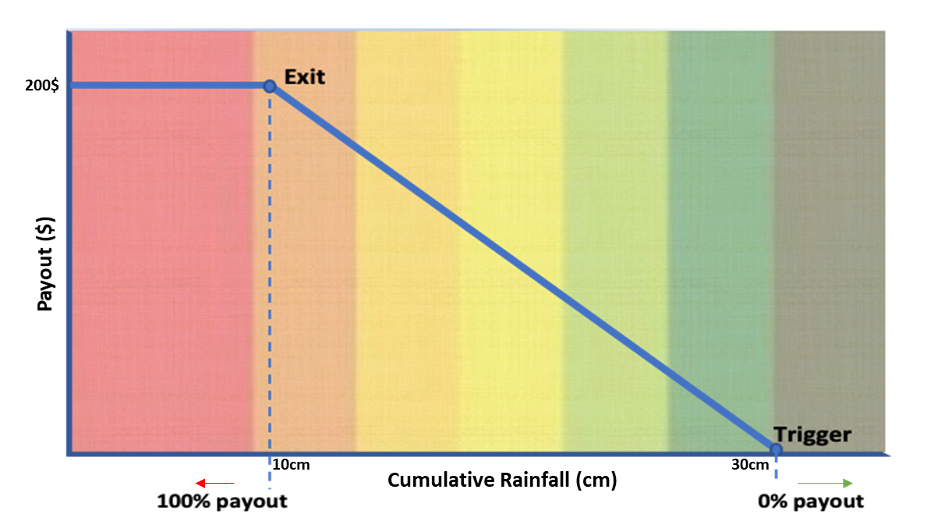

Imagine an Insurance contract written for a particular crop growing in one hectare of farm, that automatically starts to pay out if the cumulative rainfall during a certain period falls below 30cm.

This contract pays proportionately for every unit deficit (cm) of cumulative rainfall below 30 cm up until the cumulative rainfall drops to 10cm in which case, a total lump sum is paid (policy limit). [eg: at 29cm of cumulative rain during the recorded period, the contract pays 10$ and for 28cm it pays a total payout to be 20$ [(30-28) * 10]; when the cumulative rainfall is recorded to be 10cm the total dollar payout is (30-10) * tick = 200$. The “tick” is the slope of the payout curve and measures the sensitivity of the payout with respect to the weather parameter. The tick for this contract is 10$/cm. The calculation is shown below]

Here is how the payout structure of that contract looks like.

Trigger: it is the threshold value below (or above) which the indemnity payouts starts. In this case, the payout starts when the calculated index- cumulative rainfall (cm) falls below the Trigger value (30 cm).

Exit: this is the threshold beyond which no incremental payouts are made. In the above case, if the cumulative rainfall (cm) falls below Exit value (10 cm) the entire limit amount (200$) is paid.

Tick: A tick is defined as the incremental payout value for a unit increase (or decrease) in the calculated value of the triggering variable. In this case the tick value us 10$/cm [200$/(30cm-10cm)]; it means that for every cm rainfall less than 30cm (till 10cm) there is an incremental payout of 10$ unit per cm deficit (1$ per mm rainfall deficit).

Policy limit: it is the maximum dollar value that gets paid out. In this case the Policy limit is 200$.

IoT sensors, Local Weather Stations, 3rd party data- Satellites or drones capture and stream weather data periodically, which are recorded in the Blockchain. This data is irrefutable and actionable.

The smart contract monitors the parameter data coming from external sources and determines whether the monitored parameter/ Index has breached any predefined condition (as per the Term Sheet). It triggers the claims process based on that codified assessment process.

In model 1 (DLT based CBDC network) the smart contract is native to this network. It accepts the oracle data, and based on the logic triggers a CBDC payout to the citizen/beneficiary.

In model 2 (non DLT network) the smart contract emits and event which is captured by the CBDC payment infrastructure to make the appropriate payout to the citizen/beneficiary,

Since there is no survey of loss, insurance service cost is drastically reduced (expense ratio and combined ratio reduction), making a WII product more practical for implementation in a rural area than a traditional insurance contract.

Disputes are also drastically reduced since the payout is entirely data driven and the data log (irrefutable ledger of data points determining the payout) can always be verified.

to be continued...